Become a Lightspeed POS partner to earn more

Join the Lightspeed partner network to grow your business and expand your revenue streams. Empower SMBs around the world with unparalleled solutions in retail, ecommerce, hospitality and golf.

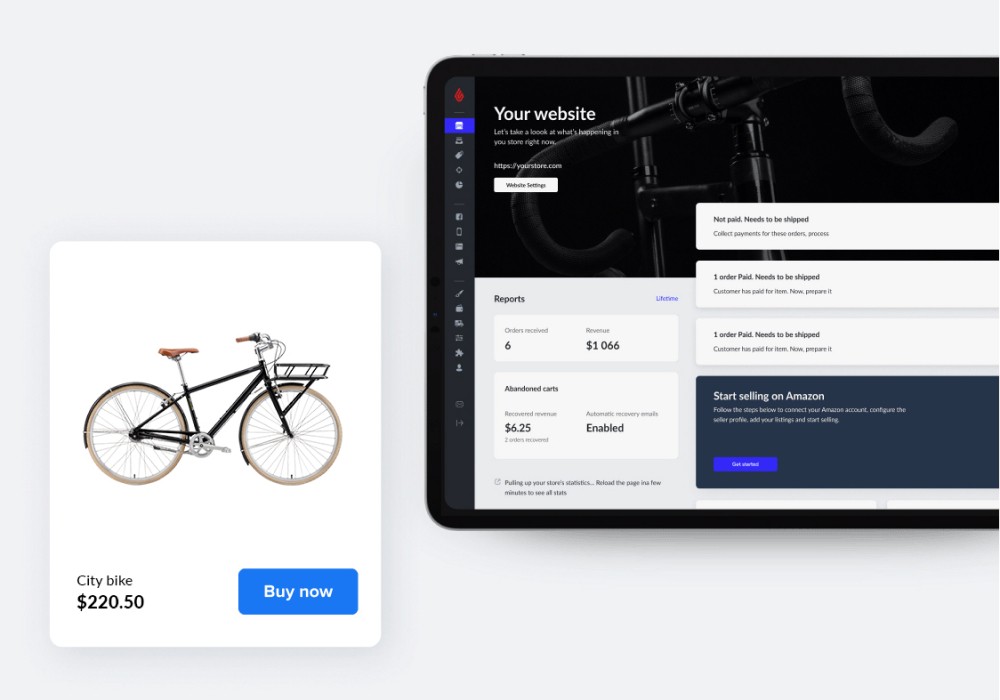

Diversify your business with our white label ecommerce platform.

Offer a powerful and unfussy ecommerce solution to your customers by reselling Lightspeed eCom.

- Easily integrate with any websites, services or tools your customers need to succeed

- Resell under your own branding and pricing, without any mention of Lightspeed

- Upsell or cross-sell your customers to increase your ARPU and improve retention

- Manage all customers’ stores with a personalized partner dashboard

What’s in it for you?

Support. Receive guidance, management and technical support from your dedicated partner team. We’re here to set you up for success.

Top resources. Access our world-class sales and marketing expertise to capture audiences and reach your goals.

Expertise. Get the latest updates, training and certification on Lightspeed products.

Community. Join our international network of partners and get access to exclusive events, including our annual Partner Summit.

What do Lightspeed POS partners sell?

Lightspeed is the one-stop commerce platform for retail, ecommerce, hospitality and golf merchants around the world.

Lightspeed Retail

Lightspeed Retail has everything your customers need to run their business. Features include:

- Intuitive inventory management to manage suppliers, track stock and set up automated reorders on a single platform

- Advanced insights showcase real-time data and make it easier to expand into new channels

- Seamless ecommerce connection to sync inventory between stores in one click

Lightspeed Restaurant

Lightspeed Restaurant has all the tools your customers need to manage their restaurant or hotel. Features include:

- Blockchain technology so that service can continue even when the Internet goes down

- Advanced reporting shows real-time sales reports, server performance, menu management insights and more

- Flexible payments that accept contactless QR code payments to turn tables faster, reduce wait times and boost revenue

Lightspeed eCom

Lightspeed eCom is the best-in-class solution for customers who sell in-store and online. Features include:

- Website building tools that can easily create a website or connect to an existing one

- Sell everywhere to reach buyers wherever they scroll—from social media platforms to online marketplaces

- Promote online with growth tools, from automated product ads with advanced targeting to built-in SEO tools, and more

Is this program right for me?

The Lightspeed POS Partner Program enables software companies, PMS partners, consulting firms, digital agencies, manufacturing businesses, food providers, restaurant distributors and more to accelerate revenue and reach new audiences.