![What is a Point of Sale System? The Definitive Guide to POS [2024]](https://blog-assets.lightspeedhq.com/img/2019/06/3a893fee-004a8481_edit_wider_sm-1024x414.jpg)

What is a point of sale system?

Most of us are familiar with point of sale (POS) systems—and interact with them nearly every day—even if we don’t realize it.

A POS system is a suite of technology, both hardware and software, used by retailers, golf course operators and restaurant owners to accept payments from customers, among other tasks.

Both large and small businesses have use of a point of sale. POS systems have enabled anyone, from business-savvy entrepreneurs to artisans who want to turn their passion into their profession, to open a business and grow.

In this article, we’ll go over all your burning POS questions and prepare you with the knowledge you need to pick the right system for your business.

- What is a POS system?

- What is a cloud-based POS?

- Why do you need a POS system?

- What are a POS system’s key features?

- What hardware does a POS system need?

- How to choose a POS system

- POS FAQs

What is a POS System?

A POS system consists of point of sale software (the commerce platform) and point of sale hardware (the cash register and related pieces that enable transactions).

Collectively, a POS system is the software and hardware that a store, restaurant or other business like a golf course needs to run their business. From ordering and managing inventory to processing transactions to managing customers and staff, the point of sale is the central hub that keeps a business running.

Together, POS software and hardware give small businesses all the tools they need to accept popular payment methods, as well as manage and understand the health of their businesses. You use your POS to analyze and order your inventory, employees, customers and sales.

POS System vs. Point of Sale?

POS is an abbreviation for point of sale, which refers to any place where a transaction can happen, whether it’s for a product or service.

For retailers, that’s usually the area surrounding their cash register. If you’re at a classic diner, where you pay a cashier instead of giving your money to a waitress, that area by the cash register is also considered the point of sale. The same principle applies for, say, golf courses: anywhere a golfer buys new gear or a drink is a point of sale.

The physical hardware enabling the point of sale system is situated in the point of sale area—the system is what allows that area to be a point of sale.

If you have a mobile cloud-based POS, your entire store effectively becomes a point of sale (but we’ll get to that a little later). A cloud-based POS system also lives beyond your physical location, as you can access the system anywhere, because it’s not bound to an on-site server.

How does a POS system work?

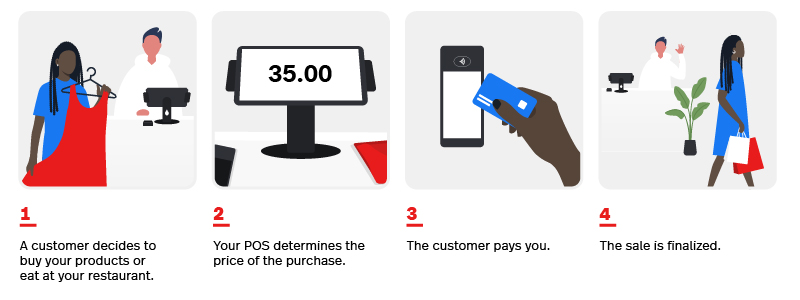

- A customer decides to purchase something—an item, food or a service.

- Your POS is full of inventory and price data, and uses that to calculate the total.

- Whether through card, cash or digital payments, the customer pays you.

- The sale is finalized; your inventory and sales data update so you have an accurate picture of your business.

What is a cloud-based point of sale?

Older (now called legacy) POS systems were completely on premise. This means they used an on-site server and could only run in a specific area of your store or restaurant. That’s why a typical legacy POS system—desktop computer, cash register, receipt printer, barcode scanner and payment processor—was all set up at a front desk and couldn’t be easily moved.

In the early 2000s, a big technological breakthrough happened: the cloud, enabling POS systems to go from requiring an on-site server to being hosted off premise by a POS software provider. With the advent of cloud-based storage and computing came the next step in POS technologies: mobility.

With cloud-based servers, large and small business owners alike could start accessing their POS system by picking up any device with internet connectivity—whether a laptop, desktop, tablet or smartphone—and logging into their business portal.

While the physical location of a business is still important, with a cloud-based POS, the management of that location can happen anywhere. This transforms the way retailers and restaurants operate in a few key ways, such as:

- Instead of being bound to a front counter, employees can bring the POS system to customers, especially if a business is using tablets. They can look up inventory and check customers out on the floor.

- Business owners can make changes to the business anywhere. Say a restaurant has run out of a particular item—the owner can quickly make a change to the menu and push it live instantly, no matter if they’re at home, in transit or on location.

- Opening up a new location or pop-up shop, or hosting a sidewalk sale or event booth, is as easy as copying the cloud-based POS software information. That means less setup time and more visibility over an entire business.

Why do you need a POS system?

So what are the benefits of POS systems? Put simply: you can’t run any size of business (small, medium or giant) effectively without one.

With a modern, cloud-based POS system, you get:

- Mobile checkout and payments

- Centralized inventory management

- Real-time access to sales reports

- Advanced customer data

- The ability to manage employees

- Integrated payment processing

- A way to manage your business anytime, on any device, anywhere

- The option to open new locations, fast

- Customer relationship management capabilities

- Integrations with top tools so you run your business your way, seamlessly

Sure, you could try using a simple cash register. You could even keep track of your inventory and finances with pen and paper. But you’d be leaving a lot of room for simple human error—what if an employee doesn’t read a price sticker right and under or overcharges a customer? How will you keep track of your inventory counts in an efficient, updated way? If you run a restaurant, what if you need to make a last-minute menu change across multiple locations?

Point of sale systems take care of all of that for you, either by automating the tasks or by giving you the tools to simplify business management and get it done faster. And beyond making your life easier, modern POS systems make things better for your customers, too. Being able to run your business, serve customers and process transactions from anywhere results in reduced lineups to pay and faster customer service. The customer experience that was once unique to big retailers like Apple is now available for everyone.

Mobile cloud-based POS systems also come with a ton of new sales opportunities, like opening a pop-up shop or selling at trade shows and festivals. Without your POS system, you’d waste a lot of time on setup and reconciliation before and after the event.

What are a POS system’s key features?

POS software powers a POS system, and includes two overarching functions:

- The cashier component (for ringing up sales in retail, taking orders and settling the bill for restaurants, and pro shop, clubhouse and tee time management for golf courses)

- The business management component

No matter the type of business, every point of sale should have the following key features to be worth your consideration.

Register software

The register software (or register application) is the cashier-facing part of POS software. It’s where the cashier will ring up transactions and the customer will pay for their purchase. It’s also where the cashier will perform other tasks related to the purchase, like applying discounts or processing returns and refunding money if needed.

Business management software

This part of the point of sale software equation either runs on a desktop PC as installed software or, in more modern systems, is accessible via any web browser. Business management software includes all kinds of advanced features that will help you better understand and run your business, such as inventory and sales data collection and reporting.

Between managing an online store, brick-and-mortar retail store, order fulfillment, inventory, paperwork, customers and employees, being a retailer is more complicated than ever. The same can be said for being a restaurateur or golf course operator. Online ordering and evolving customer habits on top of paperwork and employee management is time consuming. Business management software aims to help you out.

The business management side of modern POS systems can best be thought of as the mission control of your business. Because of this, you want your POS to integrate with the other apps and software you use to run your business. Some of the more common integrations include email marketing and accounting. With integrations, you can run a more efficient and profitable business because data is shared between each program.

A case study from Deloitte Global found that by the end of 2023, 90% of adults will have a smartphone that they use 65 times a day on average. With the internet boom and consumers adopting smartphones at an explosive rate, a host of new POS functionalities and features have emerged to help independent retailers offer a connected, omnichannel shopping experience.

Integrated payment processing

In an effort to make business owners’ lives easier, mobile POS system providers started taking payment processing in-house, officially removing complicated (and potentially risky) third-party payment processors from the equation.

The advantages for businesses are twofold. First, they can work with one company to help them manage both their business and its finances. Secondly, the pricing is often far more straightforward and transparent than with third parties. You benefit from one transaction rate for all payment methods and no startup or monthly fees.

Loyalty program add-ons

Some POS system providers also offer a mobile app-based loyalty program integration. 83% of consumers say they’re more likely to buy products from a business with a loyalty program—59% of which prefer ones that are mobile app-based. Surprising? Not really.

The use case for implementing a loyalty program is simple: to show customers that you value their business so that they feel appreciated and keep coming back. You reward their repeat business with incentives like percentage discounts and other promotions that aren’t available to the general public. It’s all about customer retention, which is up to five times less expensive than attracting new customers.

Scaling your loyal customers by as little as 5% can grow your sales by up to 75%.

When you make your customers feel like their business is appreciated and consistently suggest products and services that align with their needs, you increase the likelihood that they talk about your business with their friends.

Staff management

Modern point of sale systems can help you manage employees by making it easy to track hours worked (and through reporting, sales performance, if applicable). This helps you reward your best staff and coach those who need the most help. It can also simplify tedious tasks like payroll and scheduling.

Your POS should let you set custom permissions for managers and employees. With this, you can control who has access to your POS’ back end versus those who can only access the front end.

Whether it be through built-in features or a seamless integration (or a mix of both), you should also be able to schedule your employees’ shifts, track the hours they work and generate reports that detail their on-the-job performance (like seeing how many transactions they process, their average items per transaction, and their average transaction value).

Ongoing support

Support is not in and of itself a feature of a POS system, but good, around-the-clock support is an incredibly important aspect of the POS system provider.

Even if your POS is intuitive and easy to use, you’re bound to have questions at some point. And when you do, you’ll want 24/7 support to help you fix issues fast.

POS system support teams can typically be contacted via phone, email and live chat. Along with on-demand support, consider whether or not the POS provider has supporting documentation like webinars, video tutorials and support communities and forums where you can chat with other retailers using the system.

Retail

Beyond the key POS features that benefit every kind of business, there is point of sale software designed specifically for retailers that address your unique challenges.

Key features to look for in a retail point of sale:

- Omnichannel selling capabilities

- Customer relationship management (CRM)

- Inventory management

- Multi-store management

- Advanced reporting

Omnichannel selling capabilities

Omnichannel shopping experiences start with having an easy-to-browse, transactional online store that enables customers to research products. It ends with having an equally convenient in-store experience.

As a result, an increasing number of retailers have adapted to their clientele’s behavior by choosing a mobile POS system that allows them to run both a brick-and-mortar and ecommerce store from the same platform.

This enables retailers to look up whether or not they have a product in their inventory, verify their inventory levels at multiple store locations, create special orders on the spot and offer either in-store pickup or direct shipping.

As consumer technology evolves and consumer behaviors change, mobile POS systems are increasingly focusing on evolving their omnichannel selling capabilities and blurring the lines between online and in-store retail.

Customer relationship management (CRM)

Customer relationship management refers to tools and processes involved in interactions with customers.

Having CRM features in your POS makes it easier to offer personalized service—and, as such, make more sales that feel better for the customer—no matter who is on shift that day. Your POS CRM database allows you to create a profile for each of your customers. In those profiles, you can track:

- Payment information

- Payment history

- Favorite products

- Purchase history

- Shopping frequency

CRM databases also let retailers set up timed promotions (when a promotion is only valid for a given timeframe, after which the items on promotion revert back to their original pricing).

Inventory management

Inventory is one of the most difficult balancing acts retailers face, but it’s also the most important thing to master as it directly impacts your cash flow and revenue. That could mean anything from basic tracking of your stock levels to setting up reorder triggers, so you’re never short of a valuable inventory item.

POS systems typically have robust inventory management functionalities that simplify how retailers purchase, categorize and sell their inventory.

With real-time inventory tracking, retailers can trust that their inventory levels—both online and in their brick-and-mortar retail store—are accurate.

Multi-store management

One of the biggest advantages of a mobile POS is that it can support your business’s growth from one store to many.

With a POS system built for multi-store management, you can consolidate your inventory, customer and staff management across all locations and manage your entire business from one place. The benefits of multi-store management include:

- Manage your physical stores and eCommerce store from in one place

- Add stores, users and cash registers to your POS as you open new locations

- Create a single purchase order (PO) for all locations

- Access customer sales data across all locations

- Transfer items between stores

- Compare store performance

Data collection, reporting and advanced analytics integration

Outside of inventory tracking, reporting is one of the biggest reasons to purchase a point of sale system.

A POS should offer a variety of preset inventory and sales reports that give you insight into your store’s hourly, daily, weekly, monthly and yearly performance. These reports give you insights into all aspects of your business to help you make smart decisions that improve your efficiency and profitability.

Once you get comfortable with the built-in reports that come with your POS system, you can start looking at advanced reporting integrations—your POS software provider may even have their own reporting system, so you know it’s built to work with your data. With all that data and reporting, you can start optimizing your store.

This could mean anything from identifying your best and worst performing salespeople to understanding the most popular payment methods (credit, debit, check, mobile, etc.), so you can create the best experience for your shoppers.

These intuitive sales, inventory and employee reports let you turn insights into action and help you run your business smarter.

Hospitality

Hospitality POS systems are built for the everyday realities of running a restaurant.

Key features to look for in a hospitality point of sale:

- Menu management

- Online ordering support

- Reports and analytics

- Support for industry-specific tools

- Inventory management

Menu management

Restaurants, at their core, are their menus—the spread of offerings, the ease of order taking and the taste of the dishes.

A hospitality POS system should have menu management features that make modifying and updating menus a breeze. A cloud-based POS should give you the option to push menu modifications out to all locations at once.

You should be able to give your waitstaff access to combos and menu modifiers so they can take orders customized to the diner’s needs and tastes without trouble.

Online ordering support

Takeout and delivery are fundamental parts of the hospitality industry today.

A POS system designed for that reality will go beyond being able to handle takeout orders made on location. It should give you options—you shouldn’t be pigeonholed into only offering delivery through third-party aggregators, and neither should you have to jump through hoops to do more than handle your own deliveries.

A well-built hospitality POS system will enable you to:

- Give your customers a way to order takeout ahead of time without calling or entering your restaurant

- Enable contactless dining through QR codes, so customers can order online at their table or in line

- Handle delivery through multiple platforms and on your own with ease

Reports and analytics

Like retail POS systems, restaurant POS systems should track and report on data.

However, the exact reports you’ll be looking for differ, though you’ll also want sales reports. You’ll be able to examine menu item performance so you can identify loss leaders and best sellers, as well as dining and sales trends. You’ll have reports on staff performance and hours, and you should be able to build custom reports so you can examine the data relevant to your unique business.

Support for industry-specific tools

Running a restaurant is nothing like any other kind of business. There are industry-specific tools that help kitchens run better (like kitchen display systems) and ordering systems that customers are coming to expect (digital self order menus) you need to work with.

A hospitality POS will support these tools and integrate them fully with your system so you’re not juggling multiple disconnected tools.

Inventory management

Ingredient waste and spoilage can be a huge drain on a restaurant’s revenue. You can’t stop the inevitable march of time on your fresh produce, but having a point of sale that helps you track your usage and stock on hand helps.

Not all systems have inventory tailored to a restaurant’s needs, so you’ll need to be picky. Look for a hospitality POS that helps you track what’s been used and wasted, how much you have on hand and what you need to restock. It should calculate recipe costs and margins so you know what each dish is costing you.

Golf

Golf POS systems are also different from the retail and hospitality industries, partially because golf courses generally manage both retail and hospitality arms on top of the course.

Key features to look for in a golf course point of sale:

- Tee sheet software

- Online booking support

- Business intelligence

- Retail and restaurant POS integration

Tee sheet software

A cloud-based golf course POS system will have tee sheet software that you can access anywhere, any time. You’ll get tools to customize booking restrictions and automate billing so managing your tee sheet is easier. For recurring weekly or monthly leagues, your POS software will be able to automatically allocate tee times, ensuring you keep valuable returning customers happy.

With tee sheet software, you’ll also be able to track and review metrics about activity on your course. With attendance information, you can make decisions about hours, staffing needs and event times.

Online booking support

Digitally connected golf course POS systems are better for golf course operators and golfers alike.

You get member management tools, while golfers can book tee times online and coordinate with other members. Booking online is a simple, straightforward perk that could mean the difference between golfing at your course or somewhere else—a competitor who is more convenient.

Business intelligence

Data and reporting are important for golf course owners. And the specific data golf courses need differs from purely retail and restaurant business ventures.

Beyond the metrics being tracked through your tee sheet, a golf course POS system’s more advanced analytics can drill deep into your data and examine performance across your course, pro shop and clubhouse. You can track:

- Golfer demographics

- Staff schedules and performance

- Per-shift sales and revenue

- Inventory levels and performance

- Payment type by customer

Retail and restaurant POS integration

Running a golf course is about more than just keeping the green fresh. Your pro shop and clubhouse are key parts of your operation, so you don’t want all parts of your business disconnected from each other.

A cloud-based golf course POS system that integrates with your retail and restaurant POS gives you a better view of your whole course. It connects the experience for customers, from green to clubhouse and beyond.

What hardware does a POS system need?

The hardware products you need can vary depending on your business type. We’ve listed the most common hardware used by point of sale systems, but keep in mind that not every business needs all of these products, and some may have niche needs.

Hardware for retail, restaurant and golf POS systems

POS terminal

A POS terminal is the device that the mobile POS software runs on.

For old-school, on-premise systems, the cash register was the POS terminal. With newer options, merchants can use either a desktop computer, laptop, tablet or smartphone—any device with internet connectivity.

Many businesses opt to use tablets, like an iPad, with a stand that turns them into a countertop device. The advantage of this setup is in its inherent flexibility. Retail sales clerks have the freedom to pick up their tablet, look up inventory, access customer profiles and process transactions anywhere on the sales floor. Waitstaff can send orders directly to the kitchen without leaving the dining room.

Credit card reader

A card reader is also referred to as a credit card terminal. It’s what merchants use to accept credit and debit card payments, and allow for contactless payments at checkout.

There are three ways a credit card can accept payments:

- Reading the card’s magstripe (swiping the card)

- Reading the card’s chip through an EMV (Europay, Mastercard or Visa)

- Using near-field communication (NFC) to accept payments from mobile payment providers like ApplePay

Most consumers prefer cashless payments. By 2025, Business Insider predicts that 75% of all transactions will be cashless. Why? Because cashless payments are typically quicker and more efficient, which leave the customer with more time to do their thing.

Receipt printer

While the majority of consumers now opt for email receipts, it’s still important to offer printed receipts. If you’re running a restaurant, you’ll also likely need a receipt printer in the kitchen.

There are different types of receipt printers.

Impact printer

Sometimes referred to as a transfer or dot-matrix printer, impact printers can use either wax, resin or an ink-soaked ribbon that comes in the form of a cartridge and drops into the printer (similar to ink cartridges in a computer printer) to print receipts and tickets. They are called impact printers because the print head makes an impact on the ribbon and against the paper to print the text and images.

Impact printers are most often used as kitchen printers because they can withstand higher temperatures without affecting the printing ability.

Thermal receipt printer

Sometimes referred to as a direct printer, thermal receipt printers use heat to imprint text or images against a special kind of paper. These are the most common types of receipt printers used at the point of purchase. They are quiet, fast, efficient and cost-effective since they use a direct heat source (rather than ink) to print.

Receipt printers can connect to a merchant’s POS terminal via USB or Bluetooth. Most POS system providers can also provide you with receipt printer paper.

Cash drawer

To support customers who still want to pay cash, businesses need a cash drawer. They generally come in several sizes to support all business types. Cash register trays are inserts that go into the cash drawer. They include numerous bill tray and coin tray compartments to store and organize different monetary denominations.

The number of bill and coin tray compartments will vary depending on the size of the cash drawer. Smaller cash drawers may only have four or five coin and bill compartments, while larger drawers may have six to eight compartments.

As with barcode scanners and receipt printers, most cash POS-compatible cash drawers can connect to the POS terminal either by USB or Bluetooth.

Most POS system providers provide you with a list of compatible hardware and can get you set up with what you need with minimal hassle. With Lightspeed, you can get everything you need with our hardware kits.

POS hardware for specific kinds of businesses

While there is overlap between POS system needs, retail stores, restaurants and golf courses may also need specialized hardware.

Here are some examples.

For retailers and golf pro shops: barcode scanner

Retailers with a lot of inventory need a barcode scanner to help them manage, stock and speed up their checkout process. Similar to receipt printers and cash drawers, you can connect a barcode scanner to a compatible POS terminal either by USB or Bluetooth.

There are different types of barcode scanners.

1D barcode scanners

A one-dimensional barcode scanner is used to scan linear Universal Product Codes (UPC) on consumer goods in a retail environment.

2D barcode scanners

A two-dimensional barcode scanner is used to scan more complex codes such as Data Matrix, QR Code and PDF417. The most common use in a storefront is scanning 2D barcodes on a driver’s license for age verification.

For restaurants and golf clubhouses: kitchen display system

A kitchen display system is a digital connection to your restaurant’s POS and the orders waitstaff are inputting. It displays ticket times to keep track of turnaround, color-codes the orders to help staff see what’s cooking and lets staff manage incoming orders more effectively.

Having a kitchen display system isn’t required, but you’ll find your POS hardware setup is more efficient with one, especially during high-volume periods.

How to choose a point of sale system

You need a POS system built for your industry’s reality—a retail store needs a retail POS, a restaurant needs a restaurant POS and so on.

Within that, you need to consider size: a POS made for mid-market businesses (medium to large businesses with multiple locations) can absolutely work for SMBs, but a POS made without multi-location features will not work for anything but an SMB, and the goal for most businesses is to someday grow and scale.

So, you need:

- A POS built for your industry

- A POS that natively handles multi-location business management with ease

- A cloud-based POS (as opposed to an on-premise server) that frees you up to work anywhere

Once you’ve identified your cloud-based POS candidates, ask yourself these questions to make sure you get the right system for your business.

- How does the POS system sync your online and offline sales channels? For retailers, this means a system that connects and synchronizes your brick and mortar and ecommerce sales, with automatic inventory adjustment and shared data between channels. For restaurants, this means integrating with your delivery method of choice and streamlining the online order management process as well as it can handle the on-location orders.

- Does the POS system work for you and your employees? You need back office management task help from your POS, and your employees need to be able to easily use the system. Every employee should have their own secure login and you should be able to customize their permissions.

- Are training and support included? What good is a POS system if you don’t know how to use it? You should be offered one-on-one onboarding and have access to training resources. In addition, the more support available, the better—24/7 support is the gold standard. Don’t settle for less.

- Does the POS track and report on data? POS systems process a lot of data as they help you operate your business. The right system for your business should make that data accessible to you through a variety of reports.

- Will the POS system help you grow? Can you add more registers as you need them, whether for a permanent new location or for a pop-up shop? Is there support for multiple locations, from inventory management to customer data? Does the POS have an open API so independent developers can easily develop apps that you can add to your POS as needed?

How much does a POS system cost?

Cloud-based POS systems are paid for through subscription costs, either monthly or annually. The subscription fees go toward maintenance of the cloud servers and fund development and updates on your POS system.

For a retail or restaurant POS, you can expect to spend a little under $100 USD/month for a basic plan, with prices increasing from there for extra registers, add-ons and more advanced packages that allow you to sell efficiently on multiple channels.

Which POS is right for your business?

The POS you choose has a big impact on how you run your business day-to-day, and how you grow your business year after year.

There are a lot of options out there. We’ll help you find the right POS plan for your business. Watch a free demo to get started.

POS FAQs

What is a POS transaction?

A POS transaction is the moment where a transaction is finalized or the moment where a customer tenders payment in exchange for goods and services. Any form of payment can be used, such as cash, debit cards, credit cards, mobile payments and even accumulated loyalty points.

In order for a POS purchase to be completed, a PIN number, signature or for newer mobile payment technology, a fingerprint scan usually needs to be authenticated before an authorized transaction can be made.

The authentication information from the PIN number or other security features then travels through the ATM networks until it reaches its destination–the issuing bank. At this point, the bank can either authorize it or deny it depending on the transaction type and the funds are available in the cardholder’s account.

Some US states and counties, like California and Westchester County in New York, require a customer-facing display at the point of sale. This allows customers to see the price of each item before they pay.

What is a POS register system?

Before on-site legacy POS systems, there were POS cash registers. Old POS registers have little to no technology—they can add up purchases and store cash, and little else.

Modern POS register systems are connected to cloud-based POS software. They include a cash drawer and a card payment terminal like an old clunky register would, but the POS software controls them (mostly—if you don’t have integrated payments, an employee will still need to push the payment back to the POS system. Integrated payments are more secure).

They will have a receipt printer and a POS terminal—likely an iPad—and depending on the business type, may have a barcode scanner, a customer facing display and the like.

What is a POS payment method?

A POS payment method is any way your customers can pay at a point of sale.

Common payment methods include:

- Cash

- Credit and debit cards, including tap, chip and swipe

- Digital wallets, like Apple or Google Pay

- Gift cards

Not all POS systems support every type of payment. Some require extra card reader equipment for swipe cards, which presents a barrier to customers without a chip card—you may need to turn someone away (and lose a sale) if you’re not prepared.

A POS that can take tap payment methods will enable contactless payments.

What does POS mean in restaurants?

In restaurants, the POS is the hub of your operations. It manages sales, payment processing, online ordering, inventory, staff management and more.

Without a point of sale, restaurants need to manage these functions individually, creating inefficient processes and potentially wasteful oversights.

What are examples of POS systems?

POS systems come in all shapes and sizes (and experiences). Let’s look at three big names with distinct setups you could emulate with a cloud POS.

Most McDonalds now have self-order screens. Customers enter the restaurant, build their meal, then pay at a terminal at the screen or head to the front counter to pay in cash. The point of sale powers the self-order screens, the registers at the front counter and the connections to the kitchen display systems that let employees track orders.

At fashion retailer H&M, shoppers bring their purchases to a central checkout counter where they’ll be scanned and bagged. The point of sale is located at the counter and stores inventory information, which is updated through barcode scans and physical inventory counts.

Apple has done away with a front counter entirely, having employees carry the POS system in their pockets. They use mobile devices with card reader accessories, full of inventory and customer data. Technically, the mobile devices are the POS system, but you could classify an entire Apple store as the point of sale—the POS comes to the customer, not the other way around.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.